The HBM Memory Market Surge: A Deep Dive

Have you ever wondered about the engine behind AI’s growing thirst for data processing? Well, enter the realm of High Bandwidth Memory (HBM), where recent insights have shed light on its impressive growth trajectory. Imagine, if you will, a world where HBM sales are skyrocketing, becoming the crown jewel in DRAM chip sales for companies like SK hynix. That’s right; we’re talking about a surge to a “double-digit percentage of its DRAM chip sales” this year alone. It’s like watching a rocket preparing for liftoff, and we’re here for the ride.

SK hynix’s Bold Prediction for 2024

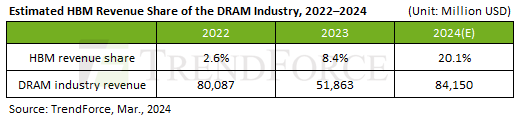

Hot off the press from Reuters, SK hynix’s esteemed CEO, Kwak Noh-Jung, has thrown down the gauntlet with a bold claim. He envisions HBM sales not just inching up but hitting double-digit percentages of their DRAM chip sales by 2024. It’s like predicting a sequel that outshines the original in a blockbuster saga. Coupling this with insights from TrendForce, which projects HBM to account for over 20% of DRAM revenue industry-wide, it’s clear we’re on the cusp of something ground-breaking.

From Billions to More Billions: The Financial Landscape

Let’s talk numbers, shall we? Without diving too deep into the accounting books, a bit of math shows us SK hynix might just be swimming in a pool of billions in HBM revenue by 2024. Given their impressive DRAM revenue streak, crossing into the billion-dollar HBM club in 2023 seems both plausible and likely. With last year’s revenue hitting the $15.941 billion mark, hitting more than $2 billion in HBM sales soon doesn’t seem like a stretch—it seems inevitable.

The Battle for HBM Dominance

In the grand coliseum of HBM market share, SK hynix is not shy about flexing its muscles, commanding a whopping 50% of the arena. It’s like watching a gladiator hold its own against formidable opponents, such as Samsung, in a high-stakes duel. With the industry’s revenue set to soar, SK hynix’s treasure chest of HBM revenue could very well dwarf its current fortunes.

The Bigger Picture: AI Servers Fueling the HBM Fire

With AI servers’ demand scaling Everest-like heights, it’s a free-for-all in the HBM production race. Here’s where the plot thickens: even Micron, the memory titan, is dipping its toes into the HBM3E waters, shipping to NVIDIA earlier this year. It’s a David vs. Goliath scenario, but in this story, David and Goliath are on the same side, expanding the pie for everyone to savor. Picture this: a $16.9 billion HBM market that turns competitors into compatriots, all basking in the glow of revenue growth.

Sources: Reuters, TrendForce